Our Initiatives

While digitisation, particularly the electronic delivery of public services and digital payments, has undoubtedly been a great equaliser across the board, there are some important segments of the Bangladesh economy that remain underdeveloped and largely excluded.

This is the issue at hand when thinking about Bangladesh’s cottage, micro, small and medium enterprises (CMSME) and bringing a greater proportion of the sector under digitisation in the spirit of inclusive innovation.

The overarching incentive for financial service providers is one of cost-cutting, namely to bring down the cost of lending to CMSMEs, which can be achieved through digital inclusion. To this effect, there are six key points:

1. Identity

Just as we have created a digital identity for individuals using eKYC, we need to create digital identities for our CMSMEs. This is the obvious first point, for any entity that wishes to be included in the digital framework, it must have a digital identity.

How to go about doing this is another matter. If we are to take trade licenses of individual organisations as their identity, then obtaining separate trade licenses will be extremely difficult. a2i however, is working on a centralised trade license system, and this could be a solution to simplifying the process.

2. Linked Transaction History

A CMSME may be conducting transactions, and digital transactions at that, through an MFS, but that does not provide them with a transaction history that is directly related to the entity.

The app TallyKhata is a good example of how this can be achieved. The existence of linked transaction history for a CMSME entity directly correlates with the next point. a2i-ekShop’s ”Bazar Bondhu” network in 4 districts is another example where an accounting system-enabled e-commerce link is pushing financial inclusion and economic resilience together in the micro-merchant segments.

3. Credit Worthiness Criteria

The only way to reduce the cost of providing credit to a CMSME entity is to figure out the creditworthiness of the entity. There are some important caveats to this issue. Firstly, this creditworthiness has to be achieved electronically; it would not be feasible to sit and interview and go over documentation of specific entities. This is where the eKYC and the linked transaction history come in to help provide a low-cost, electronic creditworthiness mechanism.

Second, with the millions of entities under the CMSME umbrella, this as an initiative must start small, with collaborative experimentation playing a key role in establishing this creditworthiness in CMSMEs, where MFS providers and traditional banks can all play a part, with support from a2i.

4. Awareness and Skills

It is vital for any entity to be aware of the precise benefits and potential drawbacks of being digitally included. For example, CMSMEs suddenly transitioning from paper transactions to a digital system may be slapped with a hefty VAT. We thus need to be mindful of the need to help CMSMEs navigate such potential issues.

Specific skills are also required to be instilled into the personnel of these enterprises. For example, if TallyKhata is the tool provided, then the skills developed must be complementary to that. For such a novel idea, with novel skill development required, a precise understanding of the context will be critical.

5. Safety Framework

This point harkens back to the original issue of transitioning to digital, namely, what are the issues a CMSME entity could face. Right off the bat, the formalities associated with the newer system will be difficult to adapt to.

However, the bigger safety concerns are common to the digital space — for example, data privacy and the risk of digital identity theft. Therefore, there is also a need for specific safety frameworks focused on the CMSMEs.

6. Partnership Framework

For all of the ideas presented above, there is a clear understanding that none of it is possible in isolation, and that there need to be multiple moving parts to achieve the desired outcomes. Just a bank, or MFS, or even the government — any one sector in isolation cannot do this. This has to be a collaborative effort, of working together.

What this means is a digital partnership framework — one built on agreements and APIs for electronic handshakes so that there is little need for signing multiple MoUs. The key here is to operate without losing business incentives and proprietary advantage for businesses, but keeping in mind that the quick electronic handshakes will be key to reducing the cost of doing business for the providers.

a2i is keen to support and accelerate the development of such a framework, and it would be central to the success of future digitisation initiatives concerning CMSMEs.

We cannot forget the demand side

While the above-mentioned points talk about the providers’ actions to help facilitate the smooth transitioning to digital for CMSMEs, as alluded to at the beginning of the post, all actions are irrelevant if there is little incentive for the CMSMEs themselves to switch to digital. This is true for the CMSMEs’ customers as well, who will also need to be incentivised to switch to digital payments from cash. Ultimately, it is only when all sides are in agreement and are sufficiently incentivised to accept changes will the process of bringing CMSMEs under a digital financial framework be possible.

On her 18th birthday, Rity got a sewing machine as a birthday gift from her aunt. She was filled with joy and excitement about the possibility of realizing her dream of becoming a fashion designer and supporting her family.

She worked day and night to create the perfect dress. Finally, when it was ready, Rity and her mom took it to the nearby bazaar. Alas, the customers there couldn’t offer her a fair price! They tried again to a nearby town. but to no avail. Rity was very upset.

At that point, Mitu, a Digital Centre Entrepreneur from Rity’s village came with a different idea.

Mitu snapped a picture of the dress. Uploaded an advertisement at major e-commerce marketplaces in Bangladesh. Enabling customers in the capital Dhaka to see Rity’s dress & buy it.

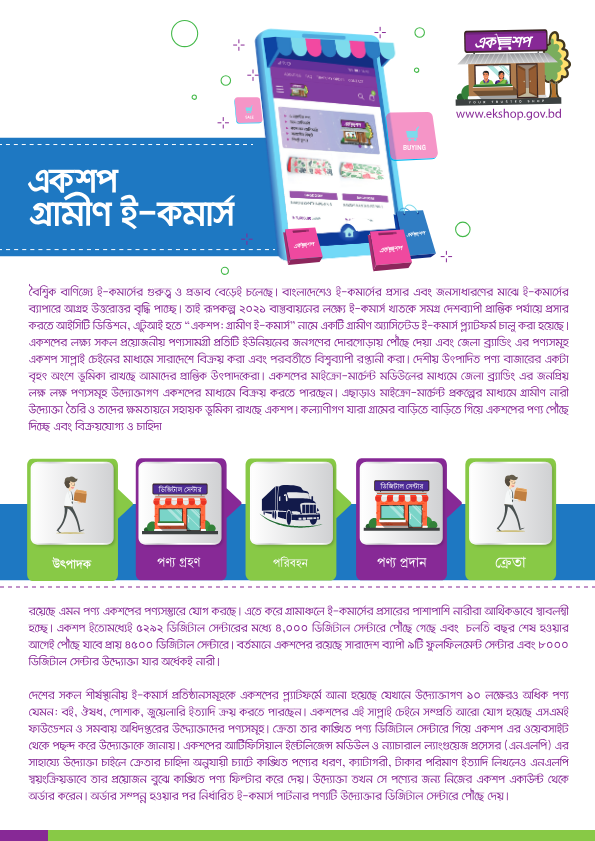

This is not just the story of Rity. This is the story of millions of rural youth, artisans and farmers in Bangladesh unable to secure a fair price for their products. And this is what inspired a2i, the flagship innovation and digital transformation program of the Government of Bangladesh and UNDP to establish ekShop.

ekShop is a unique assisted rural eCommerce model that integrates the countrywide physical network of nearly 7,000 Digital Centres. Through ekShop, Digital center entrepreneurs assist rural youth, artisans and farmers to:

Reach new, urban customers directly, bypassing multiple layers of traditional, high-cost intermediaries;

Secure a ‘fair price’ for their produce;

Open virtual shops to market and sell their products online;

Receive assistance from the Digital Centre Entrepreneurs on advertisement and promotion;

Connect and negotiate cheaper prices with logistics partners; and

Receive and make payments digitally.

To provide countrywide logistic network, ekShop has already engaged 16 local and 4 international e-commerce companies. Enabling nearly one million entrepreneurs to join the platform. To date 5 million transactions valuing $10 million has taken place.

In collaboration with the UNDP SDG Impact Accelerator, a2i is exploring ways to leverage ekShop to help the 3.5 million Syrian refugees in Turkey to secure digital livelihoods.

UNDP’s Crisis Bureau is facilitating replication of the ekShop model in Colombia, Uganda, Jordan and other countries.

As the flagship digital transformation program of the Bangladesh government, a2i strives to empower thousands of youth, entrepreneurs like Rity to realize their dreams and ensure no one is left behind.